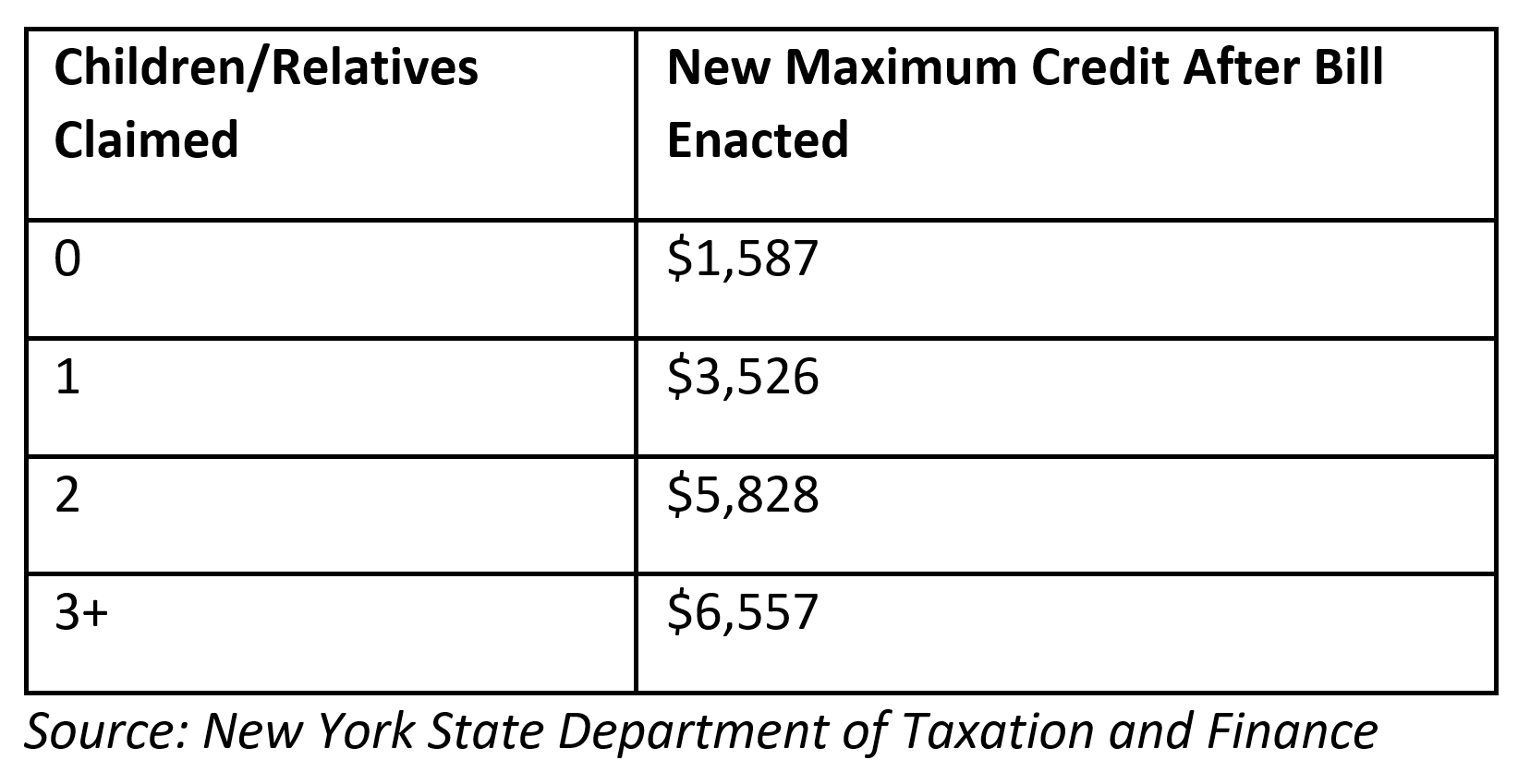

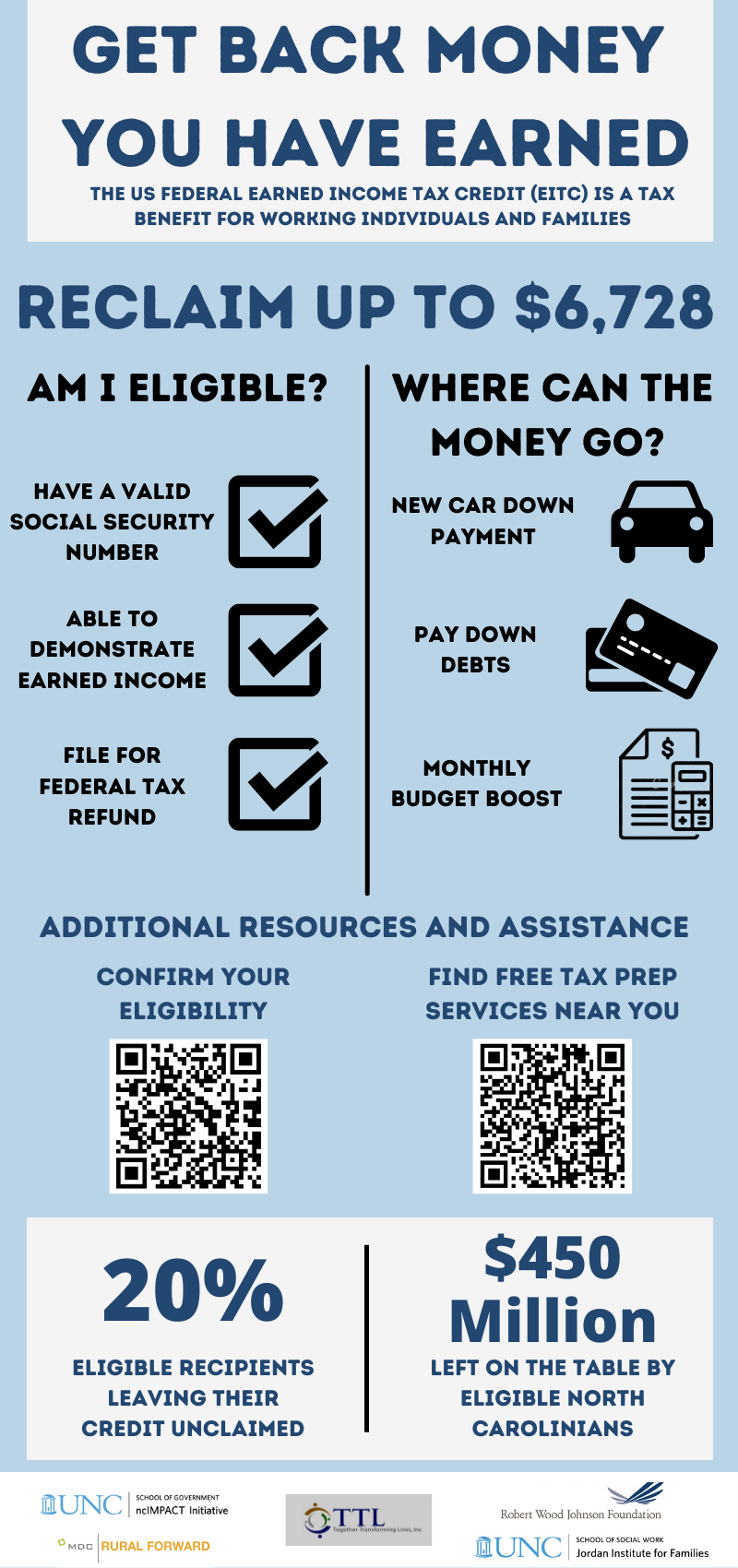

Eitc 2025 Vs 2025 Income Limits. In line with rising inflation the credit. In order to qualify and eligible for the eitc (earned income tax credit), individuals need to ensure that their earned income falls within specific yearly limits.

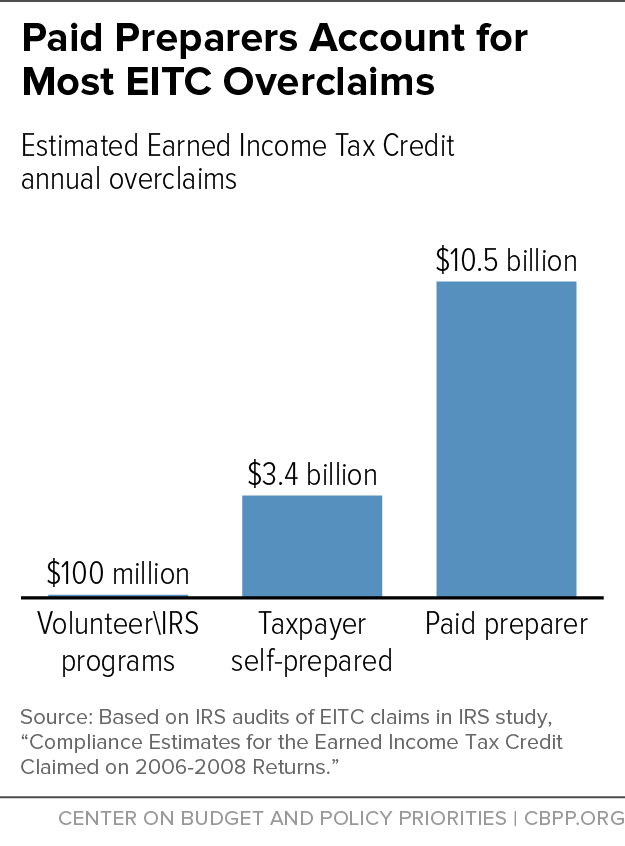

They recommend simplifying the tax. Below are the 2024 income.

Eitc 2025 Vs 2025 Income Limits Images References :

Source: orsayevelina-3w8.pages.dev

Source: orsayevelina-3w8.pages.dev

What Is Eic For 2025 Yoshi Marcella, The updated rates and brackets for tax year 2024 (taxes filed in 2025) are as follows.

Source: jennvprisca.pages.dev

Source: jennvprisca.pages.dev

What Is The Eitc For 2025 Brook Collete, Here are some popular tax credits to keep in mind for 2025:

Source: jennvprisca.pages.dev

Source: jennvprisca.pages.dev

What Is The Eitc For 2025 Brook Collete, Discover the connecticut tax tables for 2025, including tax rates and income thresholds.

Source: floreasekerrin.pages.dev

Source: floreasekerrin.pages.dev

Tax Brackets For 2025 Limits Lissi Phyllis, In order to qualify and eligible for the eitc (earned income tax credit), individuals need to ensure that their earned income falls within specific yearly limits.

Source: angelaallan.pages.dev

Source: angelaallan.pages.dev

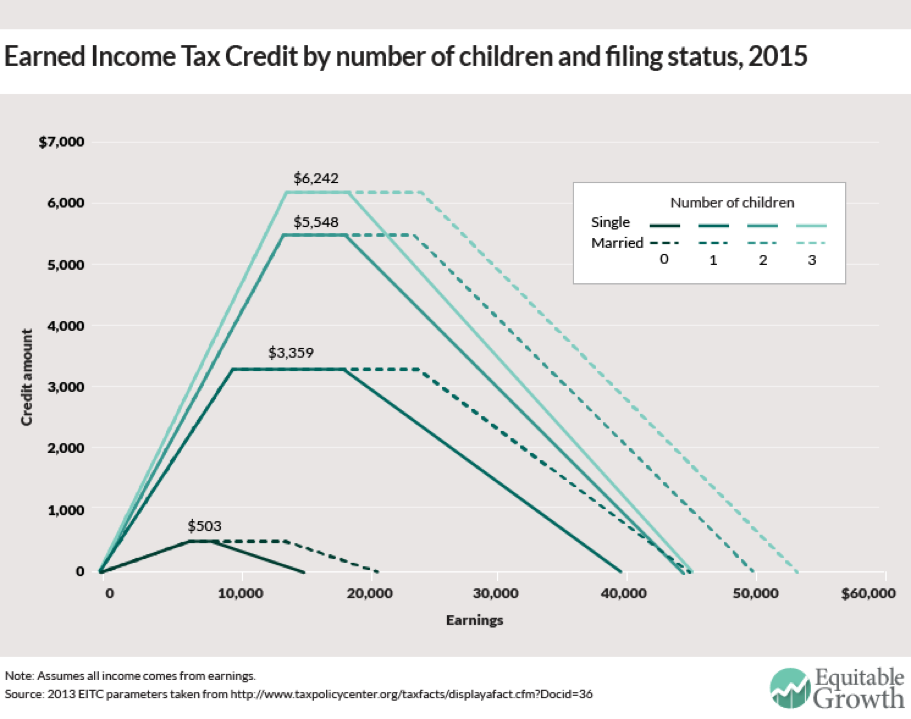

When Does Eitc Start 2025 Angela Allan, In 2024 (taxes filed in 2025), the maximum earned income credit amounts are $632, $4,213, $6,960 and $7,830, depending on your filing status and the number of children.

Source: jennvprisca.pages.dev

Source: jennvprisca.pages.dev

What Is The Eitc For 2025 Brook Collete, The tax rate is set at 10% for income between ₹ 7 lakh and ₹ 10 lakh, and 5% for earnings between ₹ 3 lakh and ₹ 7 lakh.

Source: angelaallan.pages.dev

Source: angelaallan.pages.dev

When Does Eitc Start 2025 Angela Allan, Key highlights of the eitc include:

Source: angelaallan.pages.dev

Source: angelaallan.pages.dev

When Does Eitc Start 2025 Angela Allan, The updated rates and brackets for tax year 2024 (taxes filed in 2025) are as follows.

Source: angelaallan.pages.dev

Source: angelaallan.pages.dev

When Does Eitc Start 2025 Angela Allan, In order to qualify and eligible for the eitc (earned income tax credit), individuals need to ensure that their earned income falls within specific yearly limits.

Source: hettyyzonnya.pages.dev

Source: hettyyzonnya.pages.dev

Eitc Limits 2024 Henrie Nadean, Understand the exemption limits, tax slabs, surcharges, and eligibility for.

Posted in 2025