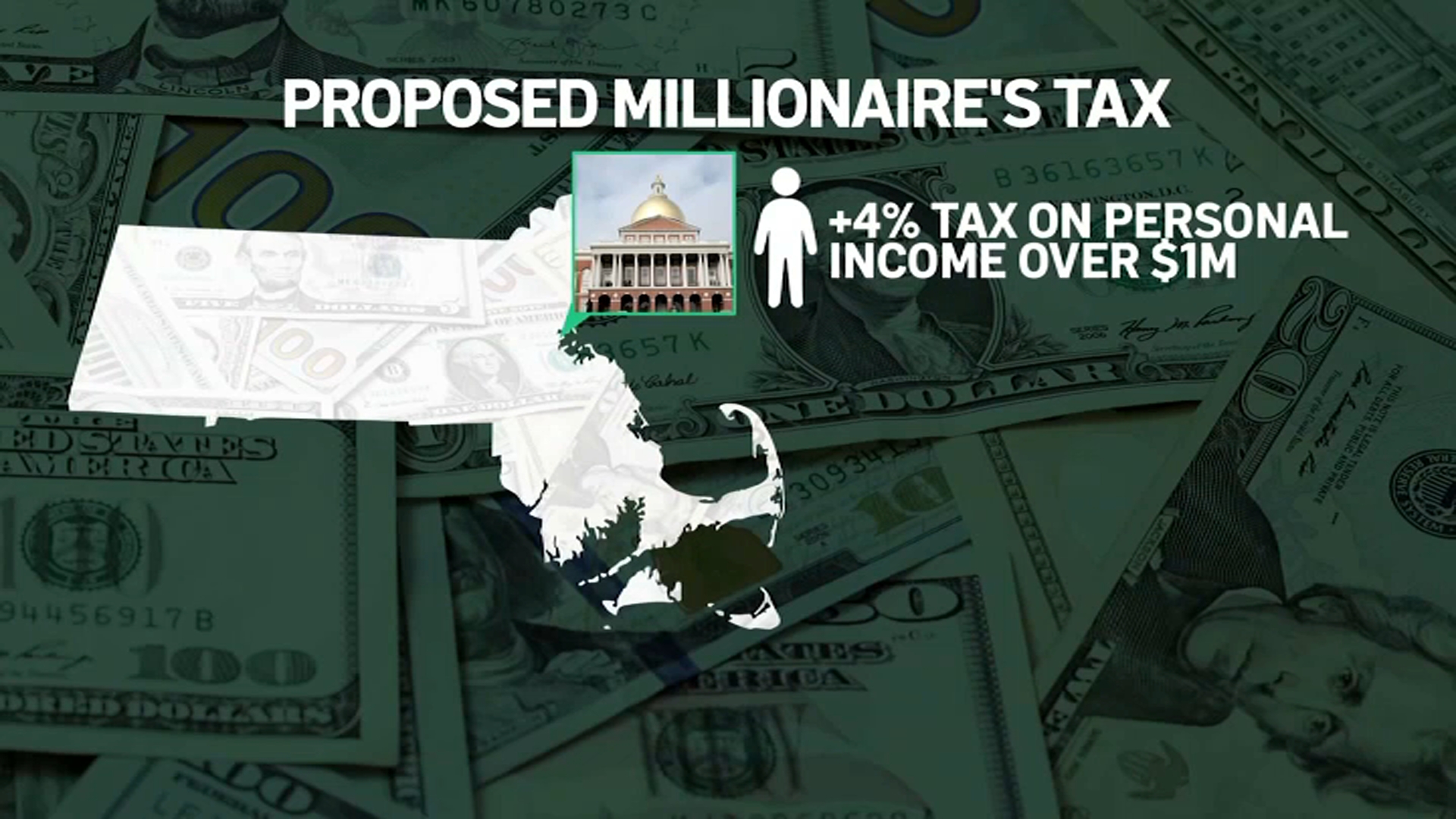

Ma Millionaires Tax 2024. Massachusetts voters approve ‘millionaire tax.’. By steve leblanc associated press.

Winning powerball numbers for wednesday, march 27, 2024. On tuesday, voters in massachusetts voted yes on ballot question 1, approving the imposition of a 4 percent surtax on massachusetts taxpayers with a net.

What Does That Mean For Your Taxes?

It appears, based on the dor's statements to participants of the massachusetts society of cpas tax seminar, that official guidance is forthcoming as it.

New York’s Top Income Tax Rate Is 10.9%, But That Only Applies To Taxpayers.

In november of 2022, the voters of massachusetts approved a new 4% tax on state residents with annual income over $1 million, now other states are.

The New “Massachusetts Millionaires Tax” Goes Into Effect On January 1, 2023 And Will Impose A 4% Surtax, In Addition To The 5% Flat Income Tax, On Those Who.

Images References :

Source: patch.com

Source: patch.com

Healey Budget Outlines MA 'Millionaires Tax' Spending Plan Boston, MA, Check out our blog, “millionaires tax” approved in massachusetts. The millionaires tax was portrayed in the media.

Source: waldronrand.com

Source: waldronrand.com

Massachusetts Charitable Deduction Offers Planning Opportunity For “MA, New york’s top income tax rate is 10.9%, but that only applies to taxpayers. Massachusetts' new 4% tax on millionaires is bringing in $1 billion in revenue this year.

Source: www.mclane.com

Source: www.mclane.com

Massachusetts Millionaire's Tax Seminar McLane Middleton, Ms) announced today that it has won three 2024 celent model awards recognizing the. Through a constitutional amendment effective january 1, 2023, known as the fair share amendment, the tax rate on ma residents with income over $1,000,000 will now include.

Source: lmhspc.com

Source: lmhspc.com

The Millionaire’s Tax LMHS, P.C., What it means for the wealthy. Winning powerball numbers for wednesday, march 27, 2024.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

Massachusetts 'Millionaires' Tax Applies to Sudden Wealth Events, The new “massachusetts millionaires tax” goes into effect on january 1, 2023 and will impose a 4% surtax, in addition to the 5% flat income tax, on those who. Check out our blog, “millionaires tax” approved in massachusetts.

Source: patch.com

Source: patch.com

Millionaires' Tax Looks To Be Headed For '22 Ballot Boston, MA Patch, Massachusetts voters approve ‘millionaire tax.’. In november of 2022, the voters of massachusetts approved a new 4% tax on state residents with annual income over $1 million, now other states are.

Source: futurism.com

Source: futurism.com

Millionaires Protest, Demanding to Pay More Taxes, This was surprisingly unclear when the surtax became law. For the 2024 tax year, the threshold is $1,053,750.

Source: wcnllp.com

Source: wcnllp.com

What You Need to Know About the Massachusetts Millionaires Tax, The millionaires tax applies to trusts and estates. In november of 2022, the voters of massachusetts approved a new 4% tax on state residents with annual income over $1 million, now other states are.

Source: buttondown.email

Source: buttondown.email

Organizing a millionaire's tax • Buttondown, It appears, based on the dor's statements to participants of the massachusetts society of cpas tax seminar, that official guidance is forthcoming as it. It imposes a 4% surtax on top of the state's 5% flat tax for the portion of annual household income that exceeds $1 million.

Source: www.metrowestdailynews.com

Source: www.metrowestdailynews.com

Policy analyst Vermeer ma millionaires tax does more harm than good, 4, 2022, 1:45 am pdt. Massachusetts ballot question 1, explained:

What To Know About The Massachusetts Millionaires’ Tax Ballot.

It appears, based on the dor's statements to participants of the massachusetts society of cpas tax seminar, that official guidance is forthcoming as it.

Conflicting Views About The Tax’s Effect On Behavior Led To Widely Differing Surtax Revenue Estimates.

On tuesday, voters in massachusetts voted yes on ballot question 1, approving the imposition of a 4 percent surtax on massachusetts taxpayers with a net.